Public Holidays in Ontario

If you feel that determining an employee’s entitled pay for statutory holidays is confusing, you’re not alone. In order to ensure compliance with the Employment Standards Act (ESA), it is critically important that you know how to calculate statutory holiday pay. To do so, Ontario provides the ES Self-Service Tool, a great resource for employers to estimate different standards accurately. This includes calculating the Monetary Standards for Public Holiday Pay.

Statutory Holidays, also referred to as Public Holidays, are holidays established by law. If the date lands on the weekend, the following workday is considered the holiday.

Each province and territory in Canada recognizes statutory holidays. While some are common across the country, others are unique to the individual province or territory. If you have employees in multiple locations, it is important to know what they are entitled to in their province or territory.

Statutory Holidays in Ontario

| New Year’s Day | January 1st |

| Family Day | Third Monday in February |

| Good Friday | Friday before Easter Sunday |

| Victoria Day | Monday before May 25th |

| Canada Day | July 1st |

| Labour Day | First Monday in September |

| Thanksgiving Day | 2nd Monday in October |

| Christmas Day | December 25th |

| Boxing Day | December 26th |

Other holidays, such as Civic Holiday, are not considered Public Holidays in Ontario.

How do I tell if an employee is eligible for Public Holiday Pay?

Most employees are eligible for stat holiday pay regardless of whether they work full-time, part-time, contracted, or temporarily. This also applies regardless of how long they have been an employee.

An employee would fail to qualify for public holiday pay for the following reasons:

- The employee fails the “Last and First Rule”.

An employee is required to work all of their last scheduled day of work before the holiday and all of their first scheduled day of work after the holiday. They fail to meet this if they don’t have a reasonable cause for not working these two days.

- If the employee agreed to work on the stat holiday and fails to work their full shift without reasonable cause.

How to calculate Public Holiday Pay

Before we can begin using the public holiday pay formula, it’s important to understand other circumstances that may arise.

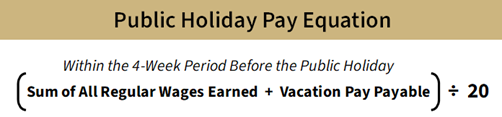

Calculating public holiday pay an employee is entitled to comes down to a simple formula using regular wages earned and vacation payable to the employee in the 4 weeks before the public holiday.

Essentially, public holiday pay is all of the regular wages earned by the employee in the four work weeks before the work week of the public holiday, plus all of the vacation pay payable to the employee within the four weeks before the work week of the public holiday, divided by 20. Let’s break that down further.

Regular Wages

Add all regular wages earned by the employee in the 4 weeks before the week the public holiday falls into. It’s important to note that “regular wages” do not include overtime pay, premium pay, leave pay, vacation pay, or pay for other public holidays.

Vacation Pay

Take note of any vacation pay the employee received during the 4 weeks preceding the week the public holiday falls into.

In some cases, employees receive vacation pay with every paycheque. If this is the case, calculate vacation pay as 4% of all of the employee’s wages earned during the 4-week period. If the employee has been employed for 5 or more years, the rate is 6%. Click here for ESA guidelines on vacation pay.

Public Holiday Pay Formula

- Add the employee’s regular wages to their vacation pay (if applicable).

- Divide this total by 20.

The result is the employee’s entitled public holiday pay!

Typical Example – Full-Time Employees

Catherine works full time, 5 days out of the week, at $120 per day. She did not take any vacation days in the 4 weeks before the public holiday.

- Regular Wages

$120/day x 5 days x 4 work weeks = $2,400

- Vacation Pay

Catherine did not take any vacation = $0

- Public Holiday Pay

($2,400 regular wages + $0 vacation pay) ÷ 20 = $120

Catherine is entitled to $120 in public holiday pay.

Part-Time Employees

Alex works part-time, 4 days out of the week, at $120 per day. She did not take any vacation days during the 4-week period before the public holiday.

- Regular Wages

$120 per day x 4 days x 4 work weeks = $1920

- Vacation Pay

Alex did not receive vacation pay = $0

- Public Holiday Pay

($2,400 regular wages + $0 vacation pay) ÷ 20 = $96

Alex is paid $96 in public holiday pay.

Full-Time Employees with Vacation Paid

Sunil works full-time, 5 days out of the week, at $150 per day. He took 1 week of vacation during the four-week period before the public holiday.

- Regular Wages

$150 per day x 5 days x 3 work weeks = $2,250

- Vacation Pay

Sunil is paid $750 in vacation pay.

- Public Holiday Pay

($2,250 regular wages + $750 vacation pay payable) ÷ 20 = $150

Sunil is paid $150 in public holiday pay.

Full-Time Employees with Vacation Paid Every Paycheque

Marcus works full-time, 5 days out of the week, at $150 per day. He has been employed for 2 years with a written agreement to be paid vacation pay on every paycheque.

- Regular Wages

$160 per day x 5 days x 4 work weeks = $3,200

- Vacation Pay

$3,200 x .04 (4% of earned wages) = $128

- Public Holiday Pay

($3,200 in regular wages + $128 vacation pay) ÷ 20 = $166.40

Marcus is paid $166.40 in public holiday pay.

What if my employee worked on a Public Holiday?

While there are certain situations where an employee is required to work on a public holiday, some employees can agree electronically or in writing to work on the holiday. If this is the case, there are two options:

- Premium Pay

An employee who worked on a public holiday is entitled to receive Premium Pay in addition to Public Holiday Pay. Premium Pay is calculated as 1.5x their regular daily rate of pay. The employee would not receive a “substitute holiday”.

- Substitute Holiday

Alternatively, an employee may receive a Substitute Holiday to replace the public holiday. This is a separate holiday that must be agreed upon by you as the employer and the employee. The holiday must be scheduled within 3 months of the public holiday that it’s being substituted for, or up to 12 months if the employee agrees electronically or in writing.

Substitute holidays are paid as public holidays in the pay period they fall on. Because of this, the employee would only receive their regular pay during the public holiday – they would not receive premium pay or public holiday pay.

Example

Rick works full-time, 5 days out of the week, at $17 per hour. He agreed to work on the public holiday and to receive Public Holiday Pay with Premium Pay (instead of a substitute holiday). He did not take any vacation days.

Calculate the Public Holiday Pay:

- Regular wages

$17/hour x 8 hours = $136 per day

$136/day x 5 days x 4 weeks = $2,720 regular wages

- Vacation Pay

Rick did not receive vacation pay = $0

- Public Vacation Pay

($2,720 regular wages + $0 vacation pay) ÷ 20 = $136

Calculate the Premium Pay:

- $17/hour x 1.5 = $25.50

- $25.50/hour x 8 hours = $204

Rick is entitled to $204 in Premium Pay and $136 in Public Vacation Pay, totaling $340.

What if my employee was on a leave of absence?

Compensation that an employee receives during a leave is not considered regular wages and wouldn’t count towards the calculation. For example, if an employee is on a leave for the full 4-week period before the week the public holiday falls on, they would not be entitled to public holiday pay.

Example

Tina works full-time, 5 days out of the week, at $150 per day. She was on a leave of absence for 3 out of the 4 weeks leading up to the public holiday. She did not take any vacation time.

- Regular Wages

$150/day x 5 days x 1 work week = $750

- Vacation Pay

Tina did not receive vacation pay = $0

- Public Holiday Pay

$750 ÷ 20 = $37.50

Tina is paid $37.50 in stat holiday pay.

Note that if Tina had been on a leave for the full 4 weeks before the holiday, her regular wages would have been $0. In that case, she would not have been entitled to public holiday pay.

Need more assistance?

At HR Performance & Results, our team of experts can help with any manner of HR issues, including statutory holidays and vacation pay. Contact us today!

Sources