The growing uncertainty about what the future holds for the global economy as a result of the U.S. tariffs has triggered action from the Canadian federal and provincial governments. New measures have been announced in an effort to protect businesses and workers across Canada against the increasing threat of a global recession. These new measures include changes to the Work-Sharing Program, temporary changes to Employment Insurance (EI), and tax deferrals.

Work-Sharing Program Changes

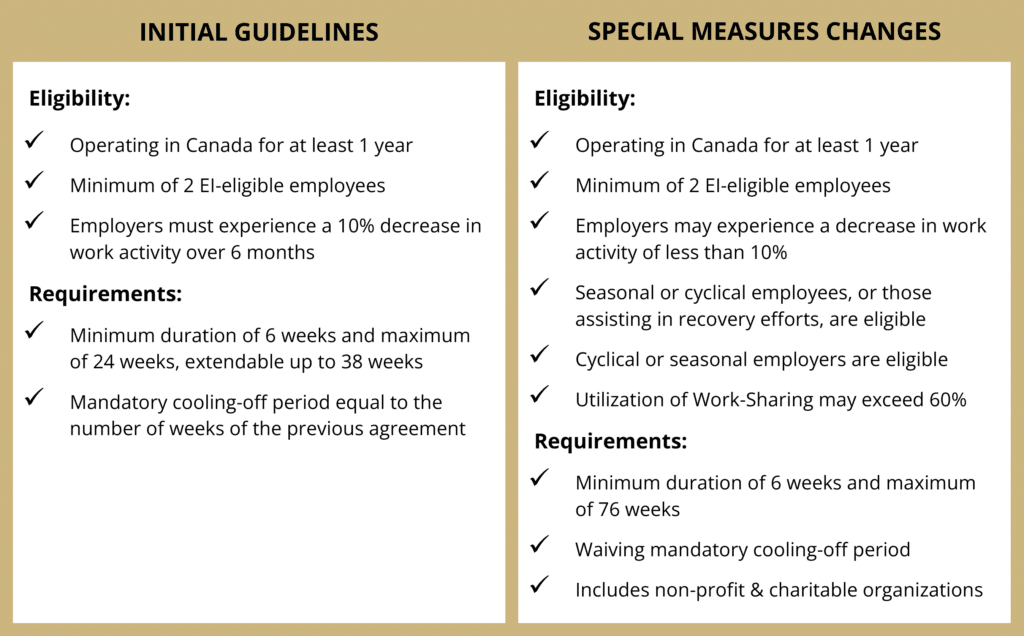

Effective from March 7, 2025, to March 6, 2026, the Federal Government has announced special measures to the Work-Sharing Program.

The Work-Sharing Program is a 3-party agreement between the Government of Canada (Service Canada), employers, and employees to help avoid layoffs in a time where there is a decrease in normal business activity beyond the employer’s control. Employees can agree to work a reduced schedule and share the available work equally, and in return, receive income support from EI benefits.

Initially, the agreements had a minimum duration of 6 weeks and last up to 26 weeks (or 38 weeks, if granted an extension). The business also must have been experiencing at least a 10% reduction to their normal weekly earnings to be eligible. After the agreement has ended, a cooling-off period was required equal to the amount of time the agreement was in effect.

Special Measures

In response to the tariffs and the potential impact on businesses, the following special measures have been implemented to temporarily change the eligibility requirements for the Work Sharing Program. The following is a summary of the new measures.

- Must have operated in Canada for a minimum of 1 year

- Must have a minimum of 2 employees eligible for Employment Insurance who agree to the Work-Sharing agreement

- Employers may now be eligible if they are experiencing a reduction in business activity of less than 10% and allows utilization of work-sharing to be exceed 60%

- Now includes non-profit and charitable organizations

- Now includes employers who are cyclical or seasonal

- Now includes employees who are cyclical or seasonal workers or employees who are assisting the employer in recovery efforts

The Work-Sharing agreement’s duration was also revised to a maximum of 76 weeks. Additionally, the cooling-off period between successive work-sharing agreements have been waived.

To learn more about special measures for the Work-Sharing Program, click here.

Temporary Employment Insurance (EI) Changes

In order to support Canadian workers and their families during the anticipated economic challenges, the Canadian Government is temporarily changing the access requirements for Employment Insurance (EI) benefits.

Waiting Period

The new temporary measure waives the 1-week waiting period before employees begin receiving benefits between March 30, 2025, and October 11, 2025, allowing benefits to begin immediately.

Suspending Allocation of Separation Earnings

Separation earnings, such as vacation pay, pay in lieu of notice, and severance pay, will not be deducted from the employee’s benefits between March 30, 2025, and October 11, 2025. This allows employees to receive EI benefits sooner.

Unemployment Rate Adjustments

A region’s unemployment rate in the region determines the number of hours needed to qualify for regular benefits. To allow better access to benefits, the unemployment rate will be artificially raised to at least 7.1% in all regions, lowering the number of hours needed to qualify. This change is applicable from April 6, 2025, to July 12, 2025. You can find more information or look up the EI Economic Region by postal code by clicking here.

To learn more about the temporary changes to Employment Insurance (EI), click here.

Support for Ontario Workers & Businesses

The Ontario government announced this week that it will be providing approximately $11 billion to provide relief and support for workers and local businesses.

Ontario Tax Deferrals

Ontario will grant relief to businesses remitting taxes under Ontario’s 10 business focused tax programs: Employer Health Tax, Insurance Premium Tax, Gasoline Tax, Fuel Tax, Mining Tax, Tobacco Tax, International Fuel Tax Agreement, Beer, Wine & Spirits Tax, the Retail Sales Tax on Insurance Contracts and Benefits Plans, and the Race Tracks Tax. This is in effect from April 1, 2025, until October 1, 2025. This will give the equivalent of around $9 billion in cash flow to keep businesses and employment stable.

WSIB Surplus Rebate

The WSIB will be issuing an additional $2 billion rebate for eligible safe Ontario employers on top of the previous $2 billion rebate that was previously issued in March.

To learn more about the relief offered by the Ontario government, click here.

If you have questions about the temporary changes for businesses or need support, contact us today!